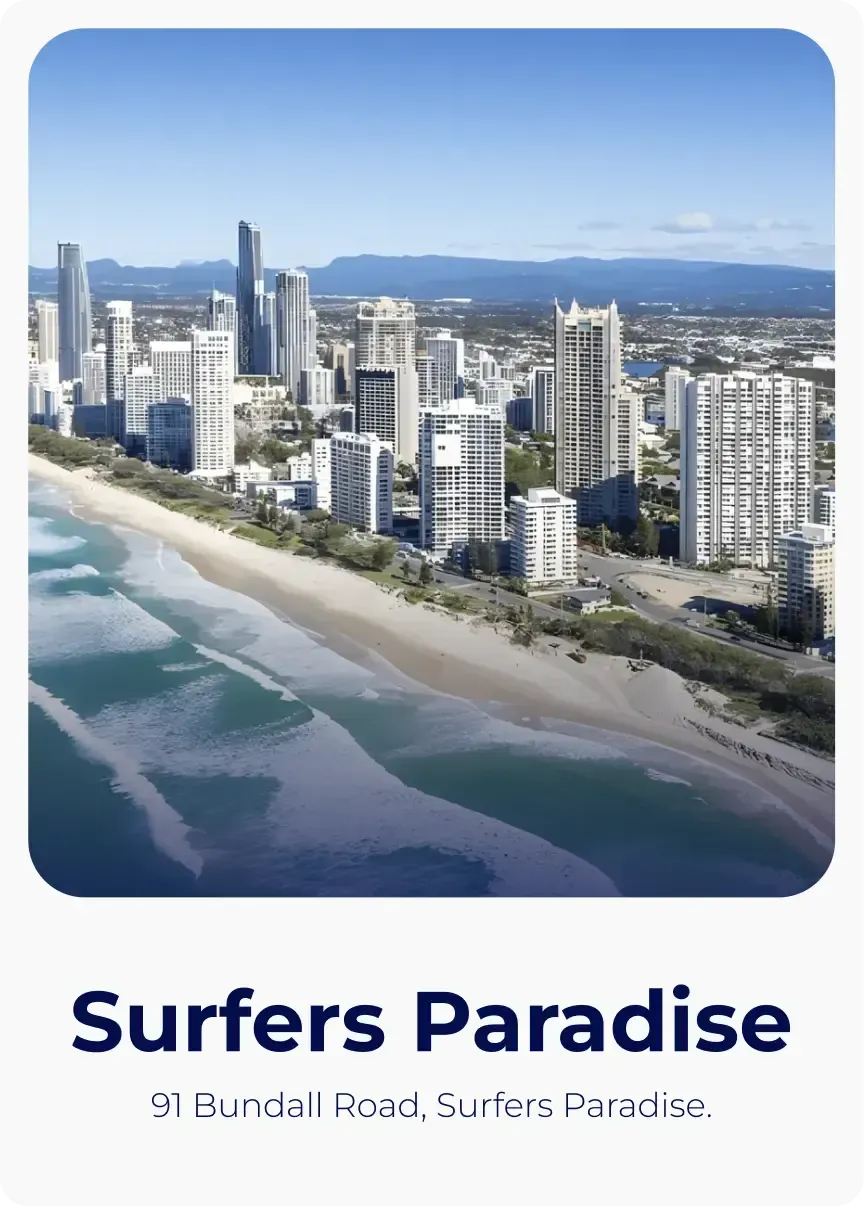

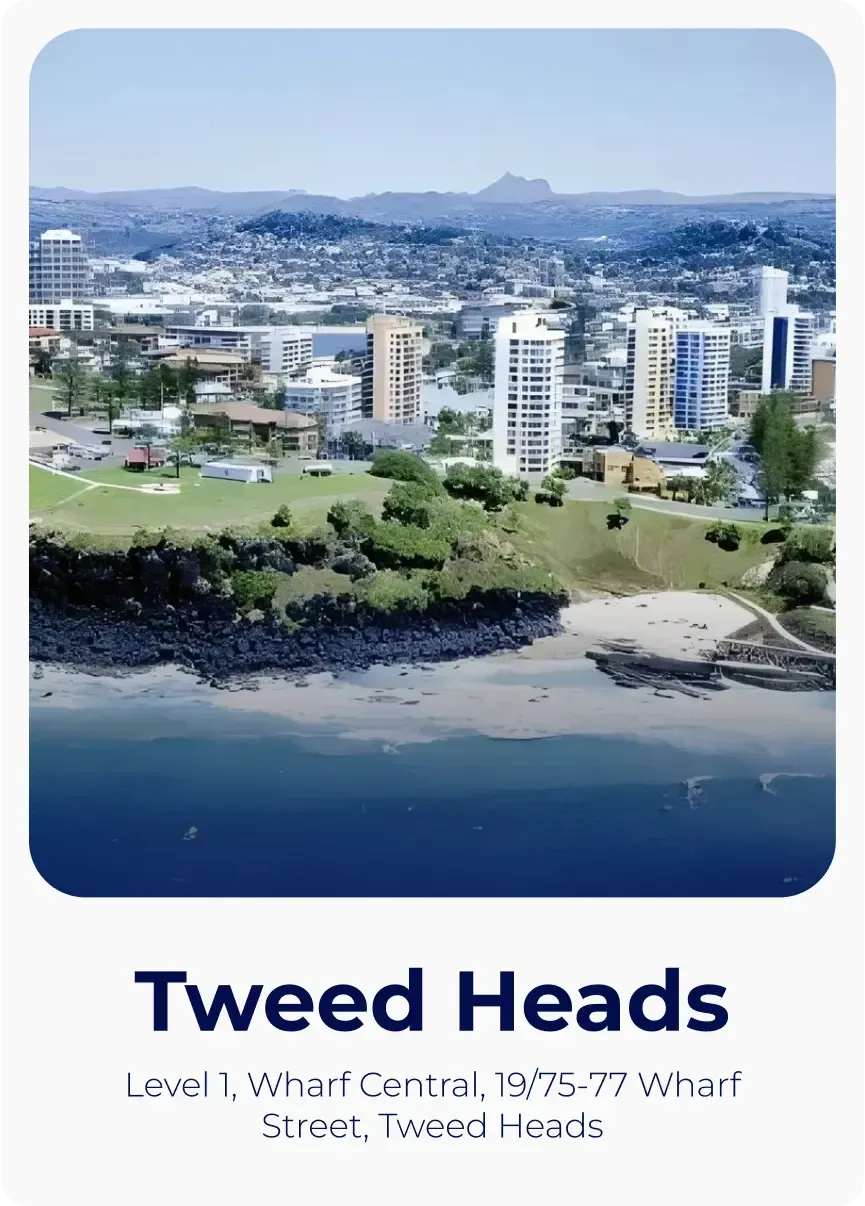

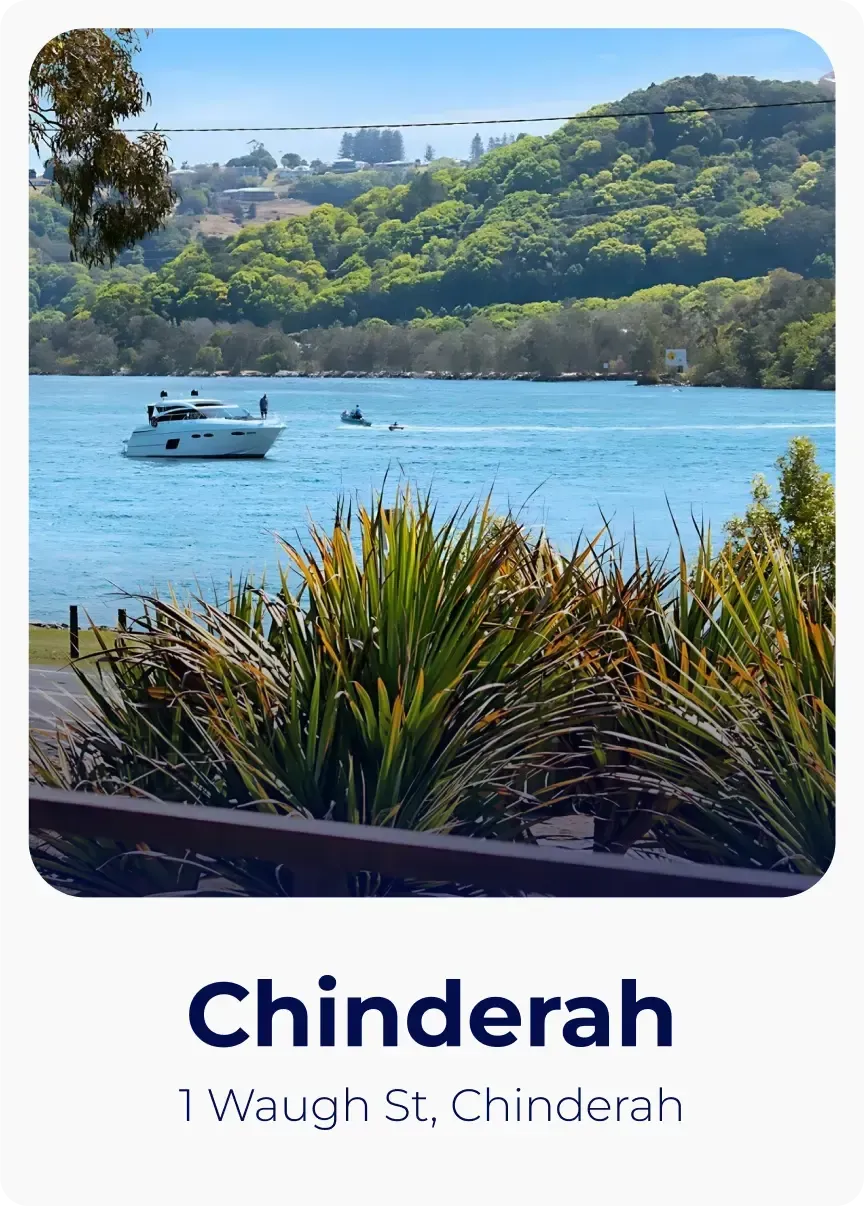

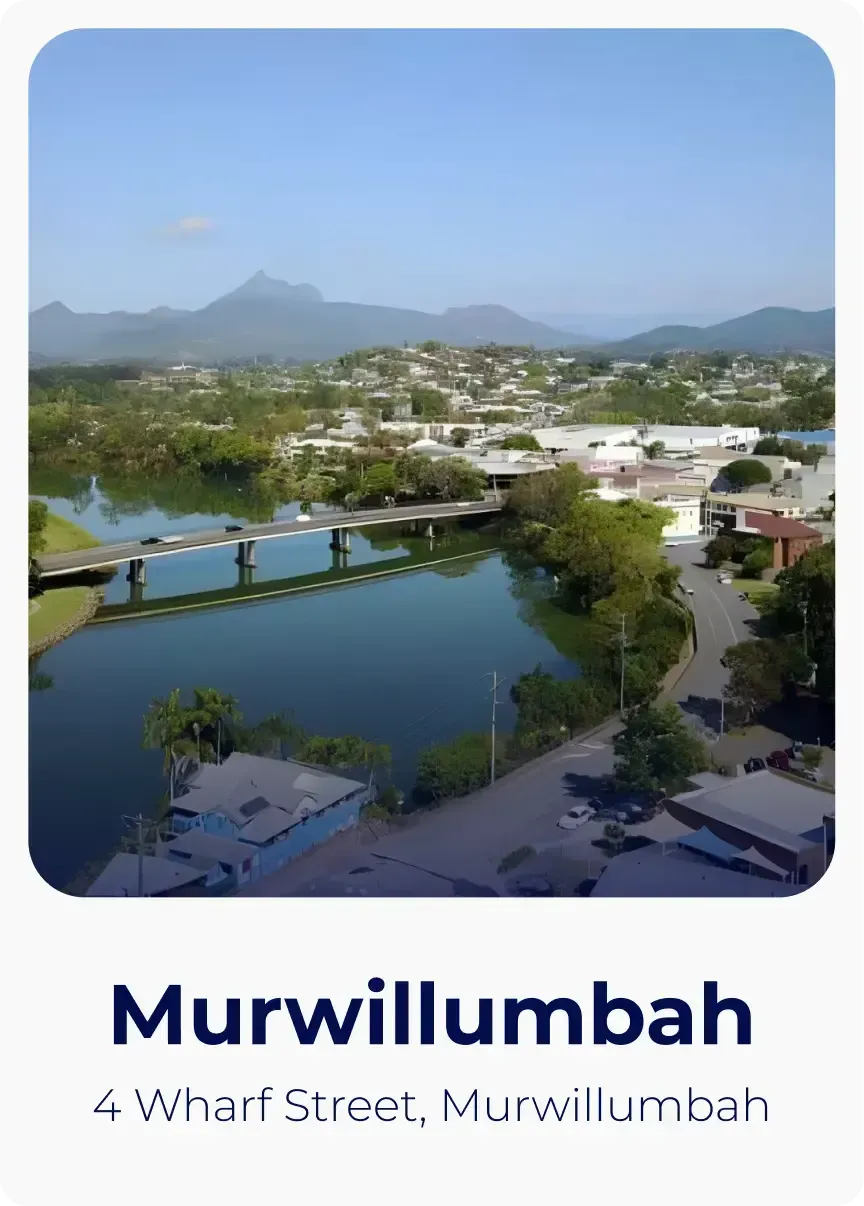

Your Local Trusted Partners

on the Gold Coast and Northern NSW

Cronin James McLaughlin Lawyers (CJM Lawyers) aims to provide our clients with the most professional level of service from our highly experienced and accomplished team of solicitors and conveyancers. We are committed to the provision of an efficient and comprehensive service offering, utilising the latest technology. Our experience, local knowledge and dedication to service ensure that clients will receive an individually tailored solution.

Services We Provide

Cronin James McLaughlin Lawyers (CJM Lawyers) aims to provide our clients with the most professional level of service from our highly experienced and accomplished team of solicitors and conveyancers. We are committed to the provision of an efficient and comprehensive service offering, utilising the latest technology. Our experience, local knowledge and dedication to service ensure that clients will receive an individually tailored solution.

Services We Provide

Your Local Trusted Partners

on the Gold Coast and Northern NSW

Cronin James McLaughlin Lawyers (CJM Lawyers) aims to provide our clients with the most professional level of service from our highly experienced and accomplished team of solicitors and conveyancers. We are committed to the provision of an efficient and comprehensive service offering, utilising the latest technology. Our experience, local knowledge and dedication to service ensure that clients will receive an individually tailored solution.

Services We Provide

Proudly United into the CJM Law Group

Proudly United into the CJM Law Group

OUR TEAM ARE READY TO HELP!

Book now for your FREE Consultation

We will get back to you as soon as possible.

Please try again later.

Charges apply to Family, Immigration and Employment Law Initial Consultations.

Charges may apply to other areas depending on the specifics of your legal situation. Please contact us for more information.

Our Trusted Partners

Our experienced legal team is dedicated to providing exceptional representation and personalised service

Shannon Mclaughlin

Director

With 20+ years in family and commercial law.

Kent James

Director

With 25 years of practical legal and commercial experience.

Jake Jeong

Partner

Experienced across litigation, family, IP, commercial, migration, and wills and estates law.

OUR TEAM ARE READY TO HELP!

Book now for your

FREE

Consultation

We will get back to you as soon as possible.

Please try again later.

Charges apply to Family, Immigration and Employment Law Initial Consultations.

Charges may apply to other areas depending on the specifics of your legal situation. Please contact us for more information.

Our Trusted Partners

Our experienced legal team is dedicated to providing exceptional representation and personalised service

Our Client's Say

Our Latest Articles

OUR TEAM ARE READY TO HELP!

Book now for your FREE Consultation

We will get back to you as soon as possible.

Please try again later.

Charges apply to Family, Immigration and Employment Law Initial Consultations.

Charges may apply to other areas depending on the specifics of your legal situation. Please contact us for more information.

Our Trusted Partners

Our experienced legal team is dedicated to providing exceptional representation and personalised service

Shannon Mclaughlin

Director

With 20+ years in family and commercial law.

Kent James

Director

With 25 years of practical legal and commercial experience.

Peter Robert Snelgar

Partner

Experienced in commercial and property law.

Our Latest Articles

Immigration

Immigration Insolvency & Bankruptcy

Insolvency & Bankruptcy